The Challenge We Solve

In many emerging economies, revenue collection remains a persistent hurdle due to widespread avoidance, evasion, and outdated systems. In 2022, Latin America and the Caribbean had an average tax-to-GDP ratio of just 21.5%—far below the OECD average of 34%. This gap in revenue limits the ability of governments to invest in infrastructure and provide critical public services.

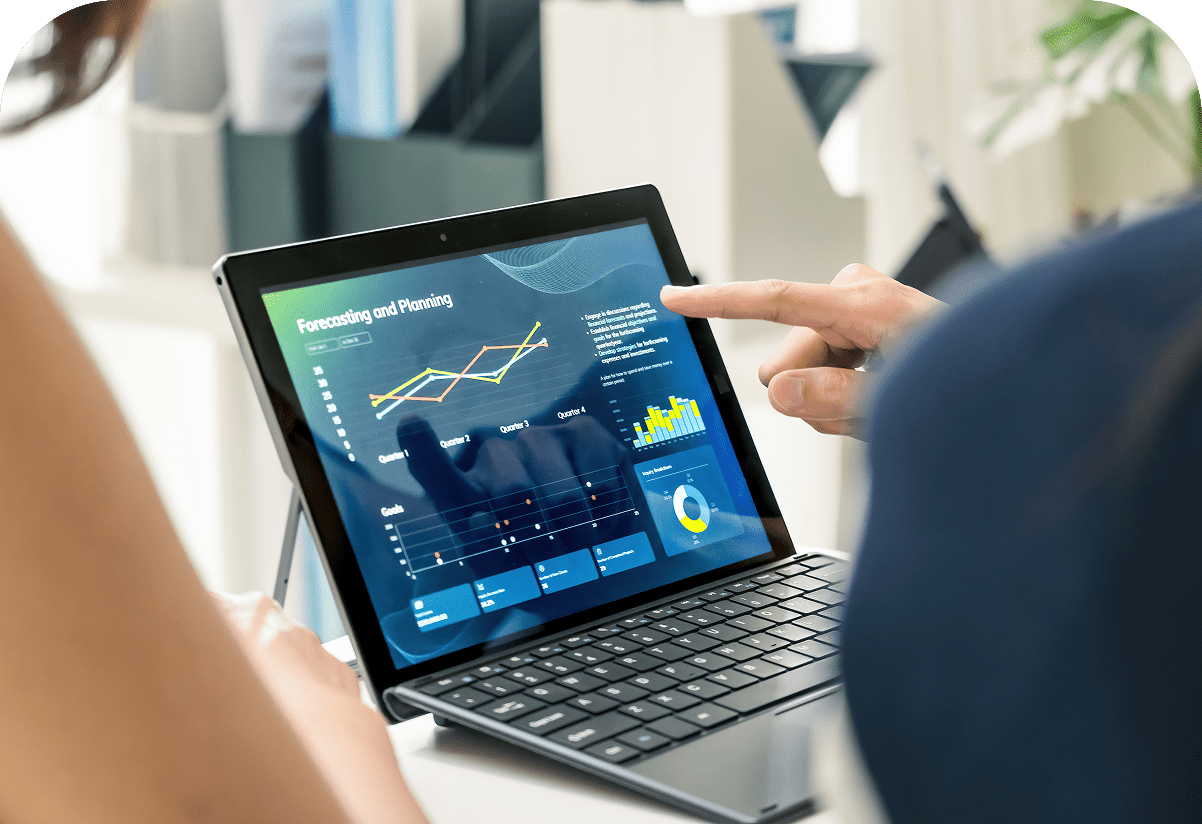

Enabling Strategic Resource Allocation

At Fidus Analytics, we understand that the key to unlocking the potential of data lies in the power of analytics. Our unique team of leading edge data scientists and experienced tax administrator, enables us to specialize in delivering comprehensive data analytics solutions to tax administrations of all sizes, helping them transform raw data into strategic and actionable insights.

What You Gain With Our Services

Focused Revenue Recovery

Our data-driven approach pinpoints high-risk accounts, enabling timely and strategic recovery of lost revenue.

Scalable Compliance Solutions

We design and deploy analytics that support targeted compliance treatments across diverse taxpayer groups—at scale.

Cost Efficiencies & Optimum Impact

By isolating the most non-compliant, high-value cases, your team can maximize impact while reducing operational costs.

Actionable Intelligence

Understand taxpayer behaviour by industry, region, and risk level to deploy strategies that align with your agency’s goals.

Top-Tier Data Security

We adhere to the highest standards of data protection and confidentiality—because trust is essential in everything we do.

The Value You Receive

At Fidus Analytics, every solution we deliver is designed with one goal in mind: to help your tax administration recover more revenue, more efficiently. By harnessing advanced analytics and machine learning, we equip your agency with intelligent insights that reveal hidden opportunities, reduce compliance gaps, and prioritize high-impact actions.

The result?

When you partner with Fidus, you’re not just investing in software—you’re investing in a smarter, fairer, and more effective path to social and economic development.

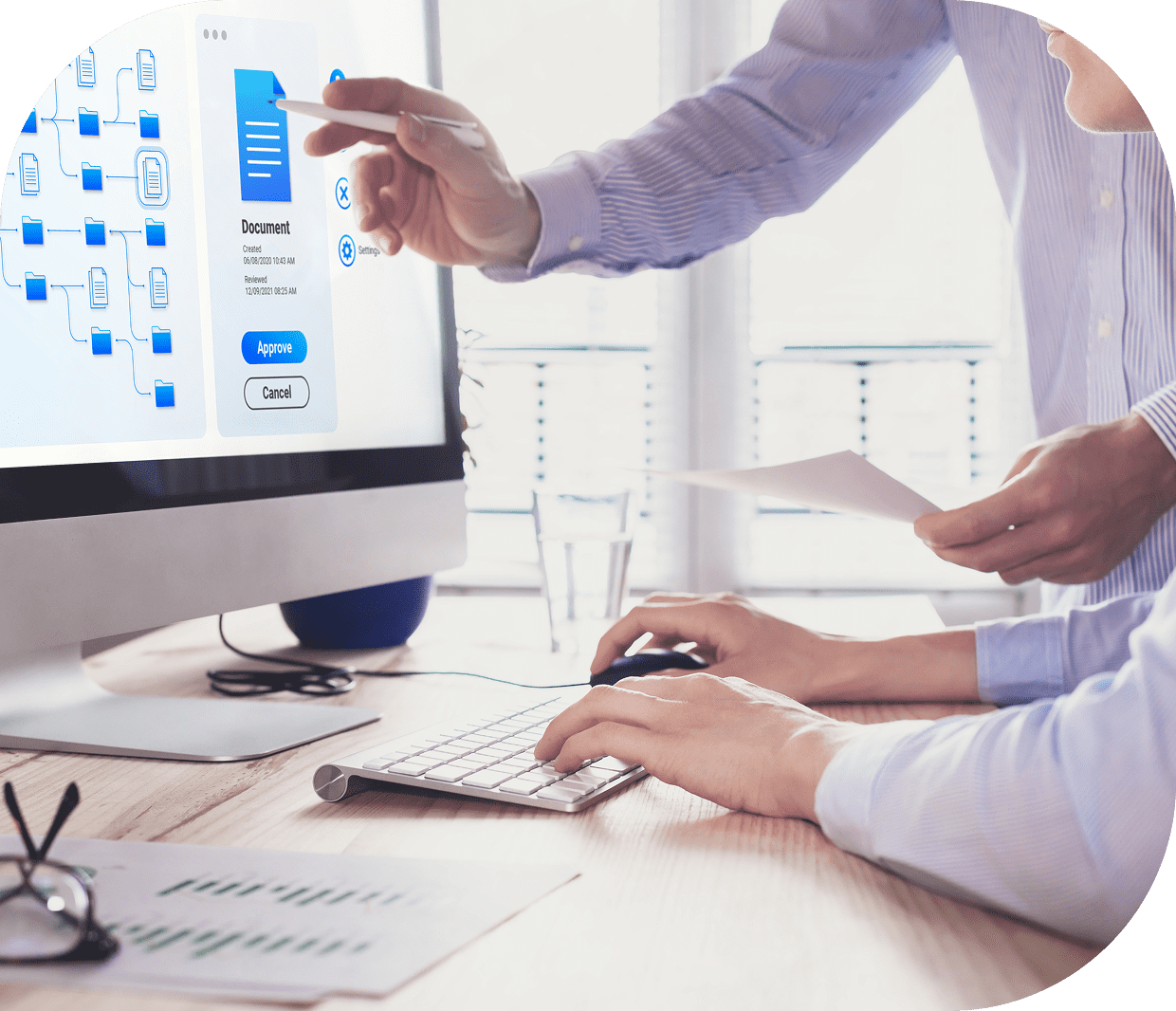

Our Breakthrough Approach

While many providers offer general analytics or advisory services, Fidus Analytics stands apart with an AI-powered platform engineered specifically for public revenue agencies. By combining domain expertise with advanced machine learning, we evaluate taxpayer and third-party data, automate risk detection, and deliver real-time, actionable insights that drive smarter decisions.

Compliance, Efficiency, and ROI

Fidus Analytics enhances fraud detection, reveals high-risk exposure, and simplifies compliance processes—producing measurable, ROI-focused results. Our cost-effective platform is ideal for governments facing budget constraints, enabling them to increase revenue, modernize processes, and optimize operations with greater speed and accuracy

Redefining Revenue Management

By uniting advanced technology with deep tax administration knowledge, Fidus Analytics fills a critical void in the marketplace. We empower authorities to improve enforcement, strengthen compliance, and increase revenues—setting a new benchmark for effective and forward-looking revenue administration

Precision-Driven Services

Customized Analytics

Tailored machine learning to maximize data-driven outcomes.

Software-as-a-Service (SaaS)

Scalable, cloud-based platform for continuous revenue recovery.

Capacity Building and Advisory

Expert support across audits, collections, and training.

Discover the Power Behind the Data

Partnering with Fidus Analytics means investing in technologically advanced systems, increased transparency, and stronger public outcomes. Let us help you build a more efficient, data-driven administration that earns respect and delivers sustainable long-term results.